What’s the Latest?

Property Tips and Tricks

Invest Smart: Max ROI

- Garage Door Replacement: Average 194% ROI

- Front Door Replacement: Get back 188% of what you spend.

- Stone Veneer: Adds a touch of luxury with a 153% ROI.

- Kitchen Remodel: Delicious returns at 96% ROI.

- New Siding or exterior: Freshen up the exterior with an 84% ROI.

Real Estate News

Interesting Times

Market Update: A Start to the Week

Major Financial Moves

- Berkshire Hathaway's Apple Stock Sale: Warren Buffett’s Berkshire Hathaway sold $75.5 billion worth of Apple stock. The company now holds a record cash pile of $276.9 billion, owning more T-bills than the Federal Reserve.

- Nvidia's Decline: Nvidia's stock is down 30% from six weeks ago.

- US Unemployment: Unemployment in the US has jumped to a three-year high.

- Interest Rate Speculation: While there was no rate cut last week, the market is now pricing in a 70% chance of a 50 basis points rate cut in September.

- Mortgage Rates: The 30-year mortgage rate recently dropped to 6.4%, boosting confidence that rates could fall into the 5% range by the end of the year.

- Sahm Rule Triggered: The Sahm rule, which has historically signaled the start of a recession, has been triggered.

- Berkshire Hathaway's Apple Stock Sale: Warren Buffett’s Berkshire Hathaway sold $75.5 billion worth of Apple stock. The company now holds a record cash pile of $276.9 billion, owning more T-bills than the Federal Reserve.

- Nvidia's Decline: Nvidia's stock is down 30% from six weeks ago.

- US Unemployment: Unemployment in the US has jumped to a three-year high.

- Interest Rate Speculation: While there was no rate cut last week, the market is now pricing in a 70% chance of a 50 basis points rate cut in September.

- Mortgage Rates: The 30-year mortgage rate recently dropped to 6.4%, boosting confidence that rates could fall into the 5% range by the end of the year.

- Sahm Rule Triggered: The Sahm rule, which has historically signaled the start of a recession, has been triggered.

Long-Term Market Perspective

It is a good time for a reminder that the market has consistently risen over the long run, even amidst short-term fear and panic over the past 50 years.

One of my favorite case-studies, from a favorite book of mine, below:

Let's say you saved $1 every month from 1900 to 2019 and you invest that dollar into the U.S. stock market every month, no matter the market climate, just keep investing every single month out of every single year. This investor is called "Sue".

But maybe investing during a recession is too scary, so you invest your dollar into the stock market only when the economy is not in a recession and sell everything when the economy is in a recession and save your monthly dollar in cash, and invest everything back into the stock market when the recession ends. We'll call this investor "Jim".

How much money would these two investors end up with over time? Sue ends up with $435,551 while Jim ends up with $257,386.

Time in the market beats timing the market.

Now that that is out of the way - let's talk some real estate.

Housing Market Overview

National Trends

- Median Home Prices: The national median home price fell from $445,000 in June to $439,950 in July.

- Inventory Growth: The number of homes for sale increased by 36.6% compared to last year, marking nine consecutive months of inventory growth. Texas, Florida, Idaho, and now Tennessee have returned to pre-pandemic inventory levels, although national inventory is still down by around 28% compared to pre-pandemic levels.

- Impact of Mortgage Rates: Declining mortgage rates are expected to continue providing a tailwind for buyers.

- Median Home Prices: The national median home price fell from $445,000 in June to $439,950 in July.

- Inventory Growth: The number of homes for sale increased by 36.6% compared to last year, marking nine consecutive months of inventory growth. Texas, Florida, Idaho, and now Tennessee have returned to pre-pandemic inventory levels, although national inventory is still down by around 28% compared to pre-pandemic levels.

- Impact of Mortgage Rates: Declining mortgage rates are expected to continue providing a tailwind for buyers.

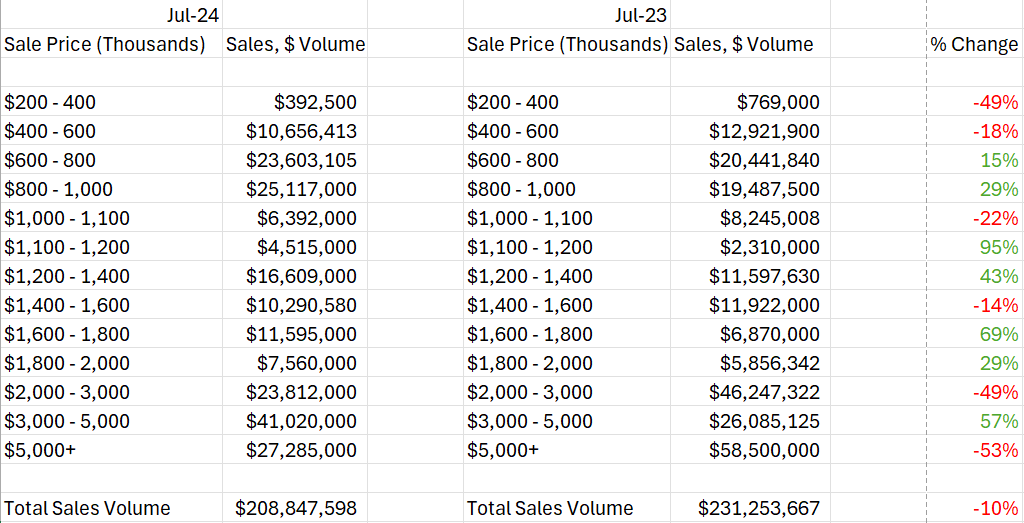

Monterey County Housing Market (Single-Family Residential)

Sales Volume:

July 2024: $208,847,598

July 2023: $231,253,667

July 2019: $223,834,539

Active Volume (Inventory):

July 2024: $1,410,426,190

July 2023: $929,247,681

July 2019: $1,818,773,887 Inventory has increased by almost 52% from July 2023 to July 2024, while sales volume has decreased by 10%. The 30-year mortgage rate was around 6.7% at the beginning of July 2023 and around 6.9% at the beginning of July 2024, indicating not a significant change in rates.

Despite the gain in inventory in Monterey County, we are still well below 2019 inventory levels.

Let's dive into the sales number by price range:

July 2023: $231,253,667

July 2019: $223,834,539

July 2023: $929,247,681

July 2019: $1,818,773,887

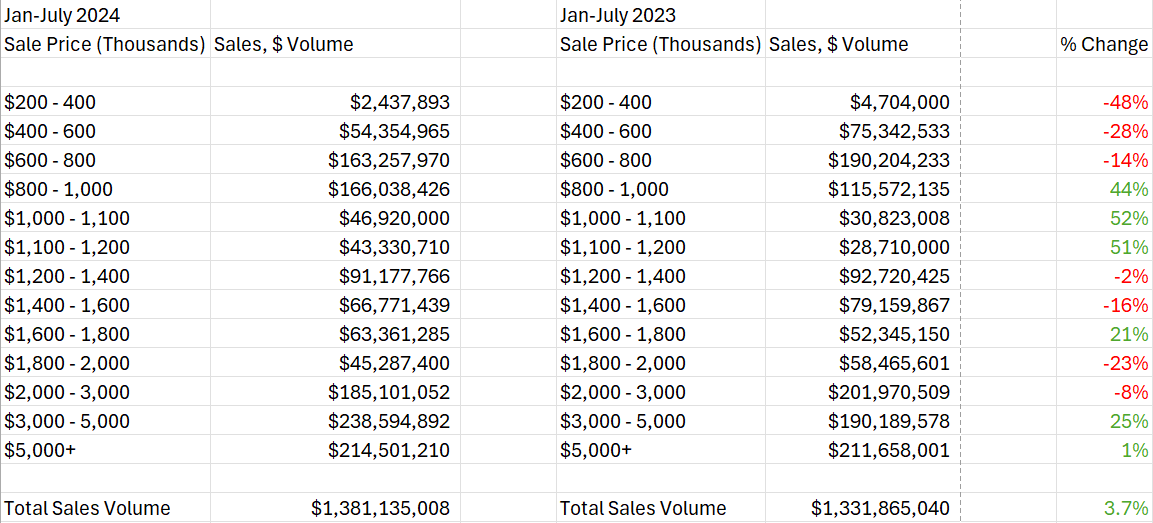

What stands out to you? For me, I can't help but notice total sales volume, but let's also look at January through July for 2023 versus 2024:

Is anything interesting to you on this graph? For me, one thing I see is how much sales are down in the sub-$800,000 range year-over-year, up in the $800,000 to $1.2MM range as well as the large increase in sales in the $3MM to $5MM range. Recently, I reported on the strong luxury home price growth across the nation. In Monterey County, luxury home sales volume is up by 5.7% so far year-over-year.

Also, we can see that the total sales volume is up a bit in 2024 versus 2023, but are we starting to notice a change in the tide since the July numbers are down? We'll keep an eye on things in the coming months.

Worked with me in the past? Share your experience.

Jonathan Balog

DRE# 01980970

Broker

M: 831.747.0310

[email protected]

Compass is a real estate broker licensed by the State of California operating under multiple entities. License Numbers 01991628, 1527235, 1527365, 1356742, 1443761, 1997075, 1935359, 1961027, 1842987, 1869607, 1866771, 1527205, 1079009, 1272467. All material is intended for informational purposes only and is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description or measurements (including square footage). This is not intended to solicit property already listed. No financial or legal advice provided. Equal Housing Opportunity. Photos may be virtually staged or digitally enhanced and may not reflect actual property conditions.