What’s the Latest?

Real Estate News

Balancing Act

As we move ahead further into 2026, the national housing market exhibits signs of stabilization: inventory levels are increasing (though remaining below pre-pandemic averages), buyers are achieving purchases below asking prices, and the mortgage rate lock-in effect is gradually diminishing. However, with a new Federal Reserve chair and ongoing AI-related developments, potential volatility remains. Locally in Monterey, demand for premium properties continues to hold firm amid broader challenges in California. Skip to the second part of the newsletter for an update on the local market.

Federal Reserve's New Direction: Chair Kevin Warsh

President Trump has nominated Kevin Warsh as the next Federal Reserve chair, bringing a hawkish perspective with certain qualifications:

Potential rate reductions: Warsh has expressed support for lowering interest rates to promote economic growth and reduce borrowing costs. However, his historical emphasis on combating inflation indicates a cautious, data-dependent approach rather than aggressive easing.

Quantitative tightening considerations: He advocates resuming quantitative tightening (QT), reducing liquidity, and selling Treasuries while redirecting focus from Wall Street to Main Street, actions that could influence bond and equity markets. Senate confirmation proceedings may moderate these positions so don't be surprised if we continue QE/money printing.

Fiscal discipline: Warsh has described excessive government spending as a primary threat to economic stability, calling for reductions, tax increases, or entitlement reforms to address deficits and prevent overlap between monetary and fiscal policy.

Perspective: Should policy shift toward continued monetary accommodation (likely due to the ongoing debt environment), real estate may benefit in the short term through rising prices. However, associated increases in costs such as insurance and taxes could further challenge affordability for many households. Hard assets may perform well; a market crash appears unlikely.

National Housing Trends: Increasing Buyer Leverage

Price negotiations: In 2025, 62% of buyers purchased homes below the original listing price, the highest proportion since 2019, with an average reduction of 8%, the largest since 2012. Opportunities for negotiation continue to expand.

Inventory growth: Active listings increased 12.1% year-over-year in December 2025, though seasonal declines brought totals below 1 million homes, still 12.5% below 2017–2019 levels. Year-over-year growth has moderated for seven consecutive months.

State-level variations: Seventeen states now exceed 2019 inventory levels; California remains approximately 3% below.

Diminishing lock-in effect: Mortgages at 6% or higher now comprise 21.2% of outstanding loans, the highest share since 2015, potentially encouraging more sellers and increasing supply as rates align closer to current market conditions.

Absence of prior bubble dynamics: Unlike the 2006 era of heavy equity borrowing, negative equity remains uncommon. Mortgage debt stands at 43.9% of GDP (down from a peak of 73.1%), and 40% of homes are mortgage-free (up from 33% in 2010). Real home prices are 2.4% below the 2022 peak.

Home-flipping returns: Profits have declined to a 23.1% ROI, the lowest since 2008, due to elevated costs.

2026 inventory projections: Forecasts indicate a 9-11% increase in active listings (to approximately 1.18 million homes), according to Bright MLS, Compass, and Realtor.com, potentially moderating prices and enhancing affordability.

Alternative perspective on rates: Housing challenges primarily arise from elevated prices rather than interest rates; Federal Reserve bond purchases could further stimulate demand and contribute to higher values.

Trade deficit reduction: The deficit narrowed 39% to $29.4 billion (lowest since 2009), supporting GDP and reducing foreign debt reliance, though influenced by factors such as tariffs and potential demand softening.

Proposed institutional buyer restrictions: Plans to limit large investors in single-family homes (representing only 2.5% of purchases) address concerns but do not resolve underlying supply constraints.

California Overview: Challenges and Opportunities

Business and resident departures: In 2025, companies including Chevron, Tesla, SpaceX, X, Oracle, Realtor.com, John Paul Mitchell Systems, In-N-Out Burger, and LandSea Homes relocated (primarily to Texas and Tennessee), citing high taxes, regulations, costs, homelessness, and safety issues. Prominent individuals have followed. Projections indicate potential worsening in 2026 due to proposed wealth tax measures, with economic impacts including a $50-70 billion state deficit and continued population outflows.

San Francisco market activity: The area shows renewed interest, driven by anticipated IPOs such as OpenAI and SpaceX, improving affordability for equity-wealthy buyers. Keep in mind the SF/Silicon Valley area is our largest feeder market, and our market historically tails that local market by 6-12 months, so we could see increased buyer activity locally from wealthy Bay Area buyers in 2026 as a result of a record IPO year.

Broader Developments: AI, Wealth, and Outlook

AI-related employment shifts: 2025 featured substantial reductions (e.g., U.S. government ~307,000, UPS ~78,000, Amazon ~30,000, Intel ~25,000), attributed partly to AI adoption alongside factors such as overhiring and cost pressures. Comparable to the Industrial Revolution's initial disruptions, AI may initially displace roles but ultimately generate opportunities in technology, healthcare, energy, and operations.

Ultra-luxury sales: All top 10 U.S. residential transactions in 2025 exceeded $100 million, reflecting strong equity market performance and concentrated wealth growth.

Local Market Takes

Looking Back at the Numbers

As we reflect on 2025, Monterey County's real estate market demonstrated resilience amid national headwinds, with increased inventory and longer market times signaling a shift toward buyer leverage. Sales volumes dipped compared to recent peaks, but prices held firm, particularly in premium segments. Below, we compare key metrics across Monterey County overall, the Monterey Peninsula, and the $5 million-plus luxury market, drawing from year-over-year and historical data (2019–2025). These insights highlight opportunities for strategic moves in 2026.

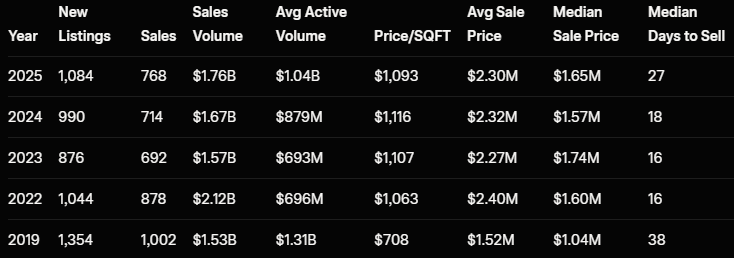

Monterey County Overall

The county saw modest gains in listings (average active volume), but sales and new listings declined from 2024. Price per square foot and median sales price rose, reflecting sustained demand despite extended selling periods.

Key trends: Listings continued to grow, but sales fell 6% YoY amid higher rates. Volume dropped 7%, yet active inventory rose 17%, giving buyers more options. Prices climbed modestly (price/sqft +1.5% YoY), though days on market increased 26%, indicating a cooling pace.

Monterey Peninsula Focus

The Peninsula outperformed the county average, with new rising listings, sales, and volumes signaling renewed activity in our coastal enclaves. Prices remained elevated, though per-square-foot values softened slightly.

Key trends: New listings grew 9% YoY, sales jumped 8%, bucking county declines. Active volume surged 18%, providing choices, while median sale prices rose 5% to $1.65M. Days to sell extended 50% YoY, suggesting buyers are taking more time.

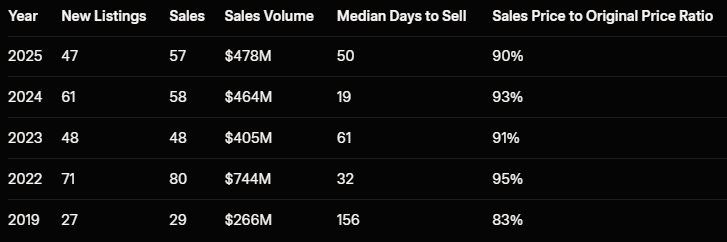

$5 Million-Plus Luxury Market

The ultra-high-end segment showed mixed results: sales decreased slightly and the number of new listings dropped, while sales volume increased slightly.

Key trends: Sales volume increased 2% YoY despite 23% fewer new listings. Median days to sell more than doubled to 50, and sales price to original price ratio fell to 90%, indicating greater negotiation leverage for buyers in this exclusive tier.

Overall, 2025 marked a transition year: similar sales volumes but rising inventory and affordability signals. For sellers, pricing strategically is key; for buyers, opportunities abound.

Worked with me in the past? Share your experience.

Jonathan Balog

DRE# 01980970

Broker

M: 831.747.0310

[email protected]

Compass is a real estate broker licensed by the State of California operating under multiple entities. License Numbers 01991628, 1527235, 1527365, 1356742, 1443761, 1997075, 1935359, 1961027, 1842987, 1869607, 1866771, 1527205, 1079009, 1272467. All material is intended for informational purposes only and is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description or measurements (including square footage). This is not intended to solicit property already listed. No financial or legal advice provided. Equal Housing Opportunity. Photos may be virtually staged or digitally enhanced and may not reflect actual property conditions.